What Is Financial Counseling? (+ Couples Financial Therapy)

How many times have you heard the phrase ‘money can’t buy happiness?’

How many times have you heard the phrase ‘money can’t buy happiness?’

If you were given a dollar each time you heard it, by now, you would be very rich.

Psychologist Daniel Kahneman (1999) suggested that money does not bring happiness, but the lack of it certainly brings misery. If you think about the times when you have struggled with little or no money and increasing debts, you were most likely miserable.

A financial counselor or financial therapist would have really helped. They focus on helping individuals and couples regain control over their finances and, ultimately, their lives.

This post explains the important role of a financial counselor and provides valuable resources for those interested in this area.

Before you continue, we thought you might like to download our three Positive Psychology Exercises for free. These science-based exercises will explore fundamental aspects of positive psychology including strengths, values, and self-compassion, and will give you the tools to enhance the wellbeing of your clients, students, or employees.

This Article Contains:

What Is Financial Counseling?

The inability to meet one’s economic responsibilities can cause significant financial stress (Northern, O’Brien, & Goetz, 2010). A sizable number of factors can cause this.

These can be a loss of work or assets, increasing debt, poor individual life choices, unexpected expenses, an increase in financial responsibilities, differences in the spending habits of people sharing a home, compulsive spending or gambling, bankruptcy, poverty, fraud and identity theft, or any combination of these factors (Shen, 2013).

Embedded in the world of psychological therapy and finance, financial counseling has gained considerable popularity in recent years. It merges financial support with emotional support to help people cope with financial stress and woes, providing a niche but much-needed service in today’s fast-paced and money-oriented society.

There is a thin margin between the point at which money brings happiness and when it brings unhappiness, and it is vital to get the balance right.

Financial stress is certainly a risk factor for mental health problems. It can cause maladaptive coping behaviors, such as drug use, gambling, and alcohol overuse (Sweet, Nandi, Adam, & McDade, 2013).

Unfortunately, many people with financial stress use avoidance behavior strategies, such as not opening bills or blocking calls from debtors. This only intensifies the stress they are already experiencing. Financial problems may also impact physical wellbeing (Richardson, Elliott, & Roberts, 2013) and relationships with family members and partners (Gudmunson, Beutler, Israelsen, McCoy, & Hill, 2007), potentially affecting the quality of day-to-day life.

So then what is financial counseling and what are the benefits of a financial counselor?

Financial counseling is “the integration of cognitive, emotional, behavioral, relational, and financial aspects of well-being” (Financial Therapy Association, n.d.).

Financial counselors come from a wide range of backgrounds: mental health, family therapy, marriage guidance, and financial services. Their counseling style depends on their background training. Their aim is to help clients control their finances, especially if they have been experiencing difficulties.

How Does It Work?

Bringing counseling into the financial world, it helps clients understand the root of their money problems and changes the way they think and feel about money.

A financial counselor will help clients change negative behaviors and attitudes toward money. They are not financial advisors. They won’t sell any services, as they are not regulated to do so.

Financial counseling is administered on a one-to-one basis. It is personal and unique to each individual, couple, or family. Financial counseling incorporates education and learning, allows for focused questions, and concerns someone’s particular situation (Collins & O’Rourke, 2012).

Financial counseling is a problem-focused way of tackling financial obstacles and issues head-on, similarly to how psychotherapy tackles psychological symptoms head-on. Financial counselors can help clients find solutions, regain control, and get their financial life back on track.

Financial counselors use a range of varied and exciting therapeutic techniques. They may ask a client to recall early memories about money and spending in childhood. Overspending or underspending can be rooted in how their parents treated money. A technique may be to write down words associated with money. Counselors may also use a traditional financial spreadsheet to aid and facilitate counseling.

Financial Counseling vs. Financial Coaching

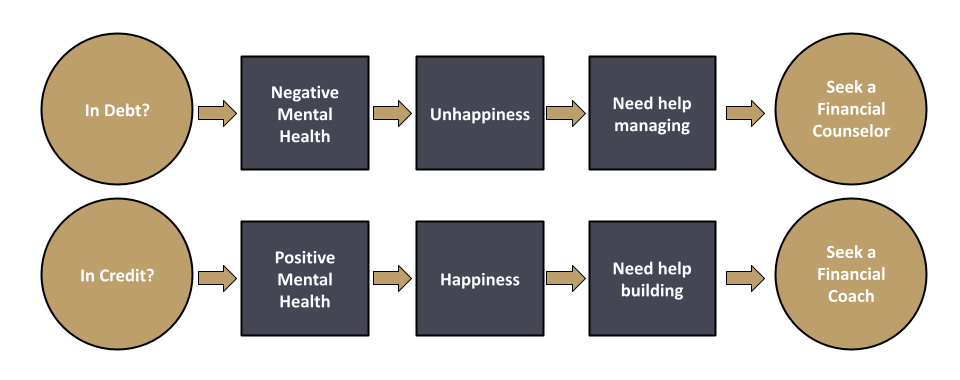

What is the difference between financial counseling and financial coaching? They are distinctly different. There is no overlap.

Financial counseling is ideally suited for someone going through financial difficulty and wanting to get out of debt.

A financial coach is not ideally suited for someone having difficulties or at a crisis point. Instead, they work with clients in a stable position, who wish to set goals to achieve financial wellbeing and accomplishment (Delgadillo, 2014). Financial coaching integrates financial concepts with coaching psychology theories (Delgadillo, 2016).

Financial coaching is a relatively new field. A financial coach will discuss goals, help establish a financial plan, and help clients understand and become more aware of how their financial situation can be improved. They do not sell specific products as those are covered under regulated advice.

A financial coach’s aim is to assist clients in becoming wiser and more savvy with money. This will help eliminate future financial stress. They allow a client to build wealth by using concrete money principles like budgeting, investing, and saving.

While a financial counselor will help a client manage wealth better, a financial coach will assist in building wealth. However, the two roles can also complement each other. For example, a client battling debt can get help from a financial counselor to get out of a crisis and then may wish to see a financial coach to stay on track, improve financial skills, build on them to achieve goals, and create wealth.

A client’s financial status will dictate whether a financial counselor or a financial coach is needed. Use the following formula to find out which professional should be consulted.

Financial counselors receive considerable certified training and take examinations to fulfill their role. Financial coaches don’t have an accredited education route. However, they need to know about financial matters and how to use coaching tools to do the job.

Clients will meet with a financial counselor over the short term to make the financial changes required to get into a better, more stable financial position, with a few follow-up meetings.

A financial coach meets with clients more frequently, over a long period. They set goals, plan actions to meet those goals, and discuss progress during each meeting.

4 Benefits of Financial Therapy

It is beneficial to seek this type of therapy when experiencing financial stress.

1. Improves mental health and wellbeing

There is a strong link between debt, financial issues, and poor mental health. A meta-analysis of 65 studies showed that people in debt are more likely to experience mental health issues than those not in debt (Richardson et al., 2013).

Because of this link, eliminating or reducing debt through financial therapy may be able to help clients improve their level of physical and psychological health and wellbeing. It could prevent stress from developing into a long-term mental health issue requiring ongoing treatment.

Overall, reducing debt may be an important part of the path toward a better quality of life and overall happiness. One of the aims of financial counseling is to help clients enjoy their families and social and recreational life.

2. Improves the relationship with your partner

Financial conflict is a good predictor of family breakdown and divorce, more so than any other source of conflict (Dew & Stewart, 2012). Financial strain is associated with increased arguments in the home and decreased time spent together in couples (Gudmunson et al., 2007).

Many relationships experience financial conflicts at some point or another due to job loss, illness, recession, or pregnancy. Couples need to understand how to cope with financial stress.

Financial therapy allows for improved communication, which can help buffer against financial pressure and improve relationship quality and teamwork.

3. Identifies better coping tools

Unhealthy spending habits and poor attitudes toward money stemming from childhood often move forward into adulthood. Financial therapy can help break this cycle.

For instance, some people may use shopping to reduce stress and anxiety; however, this behavior can quickly develop into compulsive spending. Financial therapy can help identify the emotional need met through such negative behaviors, establishing better coping tools and improving financial health.

4. Increases productivity

Financial stress causes lowered productivity at work, either through absenteeism or poor productivity (Kim, Sorhaindo, & Garman, 2006).

Resolving financial issues with the help of a financial counselor can lead to better productivity. It seems that as financial stress decreases, positive mental wellbeing increases (Sturgeon et al., 2016).

This leads to increased motivation to engage more effectively with the workplace and not to avoid it (Cox, Hooker, Marwick, & Reilly, 2009). Performance at work also increases, because clients have more headspace to focus on their job, rather than worrying about debts (Cox et al., 2009).

What’s the difference between financial counseling and financial therapy?

3 Relevant Psychology Theories

There are several relevant psychological theories and disciplines behind the field of financial counseling.

Family Systems Theory allows us to understand how we connect with money and wellbeing from a relational context. It explains why clients function with money in the way they do, because of differences in their values and perceptions shaped by their unconscious beliefs.

In couples, each partner creates their expectations and perceptions about how they should think, feel, and behave with money. These expectations and perceptions are deeply rooted in unconscious beliefs. Individuals are not self-aware of these perceptions and cannot articulate them to another person or a partner.

The cognitive-behavioral coaching discipline, more specifically Cognitive-Behavioral Therapy, is the driver behind financial therapists’ work to reduce compulsive symptoms, such as shopping and gambling, that can cause financial stress.

Solution-Focused Therapy helps clients use the skills they already have to overcome their financial difficulties. The counselor may use financial genograms to illustrate the client’s financial family history and how their relationships may influence their financial behaviors.

How Does It Work for Couples?

Skill and technique are required to avoid tense arguments around financial issues, and this is where a financial counselor can really assist.

Financial therapy for couples focuses on the emotional dynamics, behaviors, and beliefs around the couple’s relationship with money. This therapy allows couples to develop a healthier relationship with money. The counselor asks each partner about their finances while assessing their feelings, emotions, and financial goals.

The money stories we have from childhood can dictate how we perceive money and our relationship with it now. These stories can also clarify why specific things are difficult. Financial counselors can help couples have better money values to guide their spending.

This type of counseling examines money triggers and helps improve communication between partners. It also helps establish money goals as a partnership, including how each individual will contribute.

Financial therapy enables couples to develop a plan and set up a financial system to manage finances, which can help make life easier and prevent economic issues in the future.

PositivePsychology.com’s Resources

You’ll find many practical activities and exercises throughout our blog to help clients manage their financial behavior by improving their self-control and setting goals.

To help, take a look at the following resources:

- Willingness, Goals, and Action Plan

This planning template can be used to help clients identify their most valued financial goals, anticipate psychological obstacles, and implement a practical plan. - From My Way – No, My Way to OUR Way

This worksheet can be used to help couples explore their conflicting approaches or points of view and co-create a shared norm or solution to a financial problem. - Action Brainstorming

This exercise can help clients identify, evaluate, and then break or change habits that may be getting in the way of making desired financial changes or moving closer to financial goals. - The Motivation & Goal Achievement Masterclass

This masterclass is an excellent resource to help clients overcome financial issues through motivational techniques. Reaching goals is essential in terms of financial therapy and counseling. - 17 Positive Psychology Exercises

If you’re looking for more science-based ways to help others enhance their wellbeing, this signature collection contains 17 validated positive psychology tools for practitioners. Use them to help others flourish and thrive.

A Take-Home Message

Financial difficulties bring on unwanted worry. The ability to manage financial difficulties is closely related to the ability to manage daily finances.

Financial counseling is a vital service in helping both individuals and couples manage financial stress, and it can support and remedy this problem. This counseling is holistic and works to improve several life domains affected by financial stress, including mental health and wellbeing, relationships, quality of life, and productivity in the workplace. It has roots embedded within several psychological disciplines.

Financial counseling provides emotional support to create financial and therapeutic goals.

It helps break old cycles of poor financial management through a range of techniques and tools, with an outcome of an increased understanding of financial knowledge. Financial counseling provides hope to thousands struggling with their financial burdens.

We hope you enjoyed reading this article. Don’t forget to download our three Positive Psychology Exercises for free.

- Collins, J. M., & O’Rourke, C. M. (2012). The application of coaching techniques to financial issues. Journal of Financial Therapy, 3(2), 39–56.

- Cox, A., Hooker, H., Marwick, C., & Reilly, P. (2009). Financial well-being in the workplace (report no. 464). Institute for Employment Studies.

- Delgadillo, L. M. (2014). Financial clarity: Education, literacy, capability, counseling, planning, and coaching. Family and Consumer Sciences Research Journal, 43(1), 18–28.

- Delgadillo, L. M. (2016). Pedagogical experience of teaching financial coaching. Journal of Financial Therapy, 6(2), 49–64.

- Financial Therapy Association. (n.d.). About FTA. Retrieved May 10, 2021, from http://www.financialtherapyassociation.org

- Dew, J., & Stewart, R. (2012). A financial issue, a relationship issue, or both? Examining the predictors of marital financial conflict. Journal of Financial Therapy, 3(1), 43–61.

- Gudmunson, C., Beutler, I., Israelsen, C., McCoy, J. K., & Hill, E. J. (2007). Linking financial strain to marital instability: Examining the roles of emotional distress and marital interaction. Journal of Family and Economic Issues, 28(3), 357–376.

- Kahneman, D. (1999). Objective happiness. In Kahneman, D., Diener, E. & Schwarz, N. (Eds.), Well-being: Foundations of hedonic psychology (pp. 3–25). Russell Sage Foundation Press.

- Kim, J., Sorhaindo, B., & Garman, E. T. (2006). Relationship between financial stress and workplace absenteeism of credit counseling clients. Journal of Family and Economic Issues, 27(3), 458–478.

- Northern, J. J., O’Brien, W. H., & Goetz, P. W. (2010). The development, evaluation, and validation of a financial stress scale for undergraduate students. Journal of College Student Development, 51(1), 79–92.

- Richardson, T., Elliott, P., & Roberts, R. (2013). The relationship between personal unsecured debt and mental and physical health: A systematic review and meta-analysis. Clinical Psychology Review, 33, 1148–1162.

- Shen, S. (2013). Consumer debt, psychological well-being, and social influence (Doctoral dissertation, Ohio State University).

- Sturgeon, J. A., Arewasikporn, A., Okun, M. A., Davis, M. C., Ong, A. D., & Zautra, A. J. (2016). The psychosocial context of financial stress: Implications for inflammation and psychological health. Psychosomatic Medicine, 78(2), 134–143.

- Sweet, E., Nandi, A., Adam, E. K., & McDade, T. W. (2013). The high price of debt: Household financial debt and its impact on mental and physical health. Social Science & Medicine, 91, 94–100.

Read other articles by their category

- Body & Brain (42)

- Coaching & Application (54)

- Compassion (26)

- Counseling (50)

- Emotional Intelligence (24)

- Gratitude (18)

- Grief & Bereavement (21)

- Happiness & SWB (39)

- Meaning & Values (25)

- Meditation (20)

- Mindfulness (44)

- Motivation & Goals (43)

- Optimism & Mindset (32)

- Positive CBT (25)

- Positive Communication (20)

- Positive Education (44)

- Positive Emotions (30)

- Positive Leadership (13)

- Positive Psychology (32)

- Positive Workplace (33)

- Productivity (16)

- Relationships (41)

- Resilience & Coping (34)

- Self Awareness (20)

- Self Esteem (36)

- Software & Apps (13)

- Strengths & Virtues (30)

- Stress & Burnout Prevention (33)

- Theory & Books (44)

- Therapy Exercises (35)

- Types of Therapy (58)